Treasury reverses the excise duty hike on mobile money transfers

By Bashir Mohammed |

Safaricom had argued that raising the tax on mobile money transfers would undermine financial inclusion efforts and could potentially drive users towards black market money transfer services, thereby harming tax collection efforts.

Treasury has withdrawn plans to increase the excise duty on mobile money transfers. This decision is expected to benefit the vast number of Kenyans who rely on such services, particularly those using Safaricom's M-Pesa.

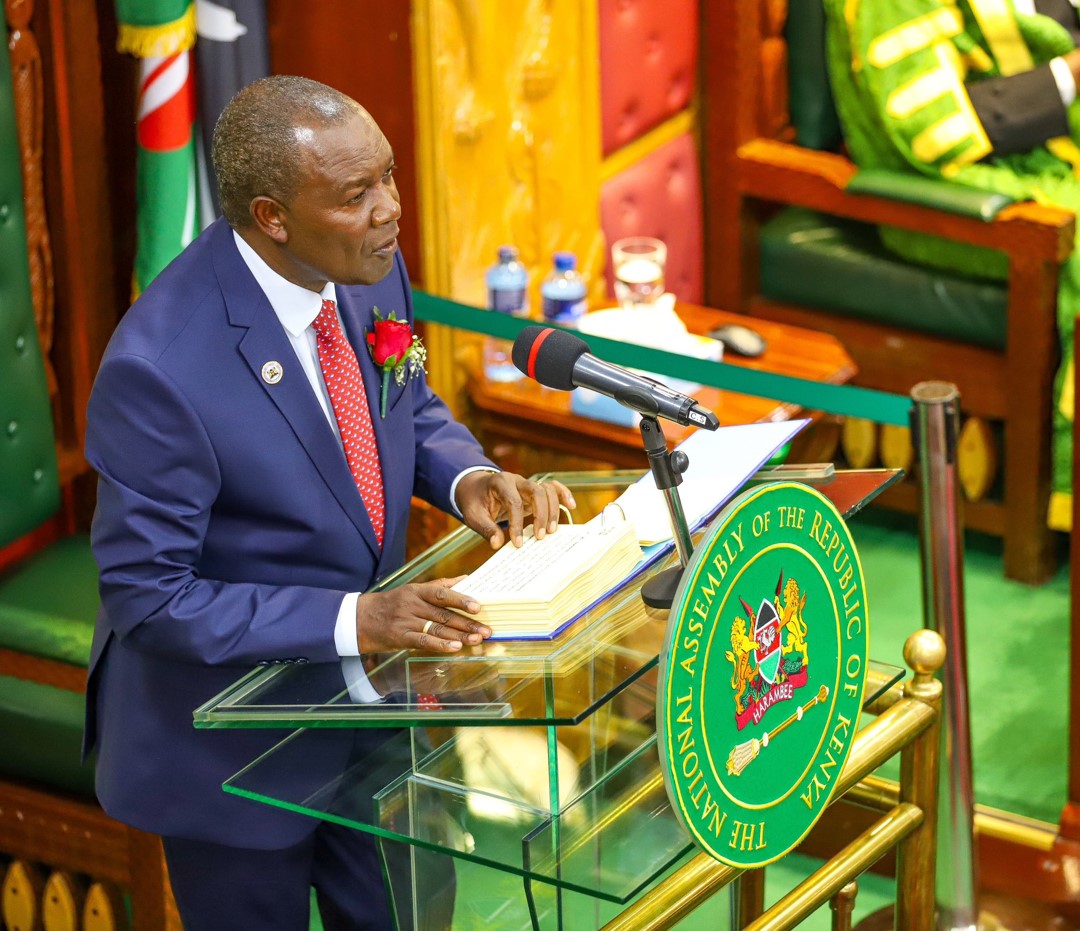

Njuguna Ndung'u, National Treasury Cabinet Secretary, announced the reversal of the proposed excise duty hike from 15 per cent to 20 per cent on mobile transfer agencies. Speaking during the presentation of the 2024/25 Budget Speech to Parliament, Ndung'u stated, "I propose to retain the excise duty rate of 15 per cent on fees charged on money transfer services by cellular phone service providers to benefit the retail electronic payments ecosystem."

Keep reading

The move comes after Safaricom, which dominates over 98 per cent of the mobile money transaction market, strongly opposed the proposed hike during public hearings on the Finance Bill 2024.

Safaricom had argued that raising the tax on mobile money transfers would undermine financial inclusion efforts and could potentially drive users towards black market money transfer services, thereby harming tax collection efforts.

A representative from Safaricom emphasised to MPs last week that higher transaction costs would deter ordinary citizens, or "mwananchi," from accessing essential services. The telco highlighted that mobile transfer fees have traditionally been lower compared to other financial transactions, reflecting the service's role in catering to the unbanked population.

In the financial year ending March 31, 2024, Safaricom reported a 33.9 per cent increase in M-Pesa transaction volumes, rising from 21.2 billion to 28.3 billion transactions. These transactions' value increased by 9.6 per cent from the previous year, reaching Sh40.2 trillion from Sh36.7 trillion.

This growth underscores the critical role of mobile money in the economy. Safaricom's revenue from these services rose to Sh139.9 billion, up from Sh117.2 billion in the previous period.

Data from the Kenya National Bureau of Statistics indicated that the value of mobile money transactions reached Sh7.95 trillion in 2023, a modest 0.57 per cent increase from the previous year’s Sh7.9 trillion. This growth rate was the slowest in four years, reflecting potential market saturation and economic challenges.

Despite maintaining the excise duty on mobile money transfers, the Treasury has retained its proposal to increase the excise duty on telephone and data services, as well as fees charged by banks, money transfer agencies, and other financial service providers, from 15 to 20 per cent.

This proposal has sparked criticism from industry players, including the Kenya Bankers Association (KBA), who argue that it contradicts efforts to enhance financial inclusion.

Analysts from KPMG caution that the increased excise duty on telephone, internet data services, and other financial services could result in a decline in transaction volumes, ultimately reducing excise duty collections. "The increase in excise duty on telephone and internet data services, fees charged for mobile transfer services and other financial services may lead to a decrease in the number of transactions, thus causing a decrease in excise duty collection," KPMG noted.